How to Lower Your Company COGS

Increasing sales isn’t necessarily the best way to improve your bottom line. A better solution may be to reduce your Cost of Goods Sold.

Paying less to acquire the products you sell can result in higher gross revenue figures and bigger profits, even when the amount of product you sell stays the same.

If you’re ready to make more money without selling more products, here’s a recap of COGS and specific strategies to lower expenses.

A Quick Recap of Cost of Goods Sold (COGS)

What Is Cost of Goods Sold?

The Cost of Goods Sold (COGS) is all the costs of producing and acquiring the products you sell. You can separate COGS into two parts: direct costs and indirect costs.

Direct costs are the expenses incurred when producing the products you sell. They include:

- raw material costs

- labor costs during production

- other production overheads

- the cost of wholesale products

Indirect costs are all the other expenses incurred when you manufacture products that aren’t tied directly to the process. They include:

- storage

- shipping

- labor

- custom duties

- software

- packaging costs

It’s also worth clarifying what COGS is not.

Your COGS is not the same as your operating expenses, for example. Both are expenditures, but operating expenses (also known as OPEX) are not tied to your products’ production. Instead, they include costs like rent, utilities, marketing, and legal.

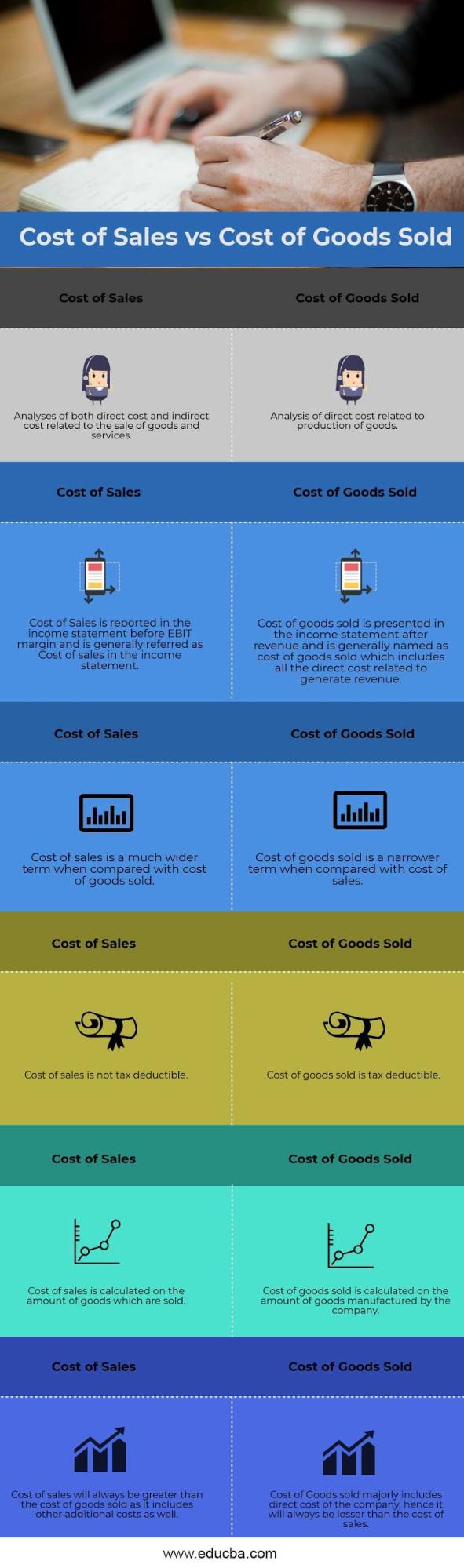

They also aren’t the cost of sales either, as this infographic from EDUCBA shows.

How Do I Calculate Cost of Goods Sold?

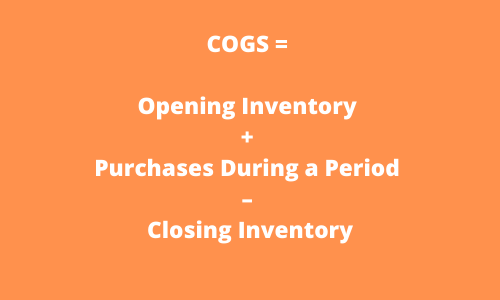

Businesses can calculate COGS using a standard formula that considers inventory levels and all of the direct and indirect costs listed above.

COGS = Opening Inventory + Purchases During a Period – Closing Inventory

- Opening Inventory is the value of inventory you hold at the start of a given period (like a financial year.)

- Product purchases and all resulting costs (as listed above) are added to the opening inventory.

- Closing inventory (the value of products that aren’t sold at the end of the period) is subtracted from that total to calculate the final Cost of Goods Sold.

Here’s an example:

Let’s say we want to calculate an e-commerce brand’s COGS during the 2019 financial year. The opening inventory would be the inventory recorded at the end of the 2018 fiscal year. Let’s say it’s $2 million.

The closing inventory would be the inventory recorded on the company’s balance sheet at the end of the 2019 fiscal year. Let’s say that is $3 million. Finally, the company purchased $5 million worth of inventory during the 2019 fiscal year.

The COGS for the 2019 financial year is:

2 + 5 – 3 = $4 million

The COGS is $4 million.

If you want to see what calculating COGS looks like in the real world, Investopedia provides an example using J.C. Penney’s 2016 financial report.

The calculation can also change depending on how you define closing inventory. There are three options:

- FIFO (first in, first out): The first item you add to your inventory is the first item that gets sold. This option will minimize the COGS as long as the price continues to rise.

- LIFO (last in, first out): The last item you add to your inventory is the first item that gets sold. If prices are rising, this will maximize the COGS and reduce profit.

- Averaged costs: Costs are taken as an average, offering a balance between FIFO and LIFO.

Why Should I Think About COGS?

COGS is a crucial line on your balance sheet. By paying attention to it, you can:

- Identify profitable products. Calculating your COGS will help you determine which products are most profitable and which aren’t.

- Price accurately. Knowing your COGS will help you price your products. When you know the cost of every product you sell, you can make sure you’re pricing in a healthy margin.

7 Tips to Reduce COGS

Now that you’re up to speed, it’s time to get to the heart of the matter and look at how you can reduce your company’s COGS.

I’ve outlined seven strategies below that almost any business can leverage.

1. Stop Making Products That Don’t Sell

Do you have a large amount of sitting in your warehouse? These are products that haven’t been sold and are unlikely to sell in the future. If so, they could be killing your margins and contributing massively to your COGS. Remember, the COGS calculation takes into account the inventory you have at the start and end of your accounting period. It doesn’t matter how long it’s been sitting there: it’s going to be in the calculation.

Deadstock isn’t great, but there’s an easy way to make sure it doesn’t increase your COGS going forward: Stop making products that don’t sell.

Of course, no business owner starts out intending to make a product consumers hate, but it happens. Even the biggest businesses have flops now and again. New Coke, anyone? I didn’t think so.

Don’t worry about creating the wrong products, only worry about identifying ones that aren’t selling well. Use inventory management software to identify products languishing at the back of your warehouse.

Encourage customers to review your products to drive real-time feedback from the people that matter most. Then act quickly. As soon as you identify an under-performing product, take steps to decrease production or cease selling it altogether.

2. Find Lower Cost Materials

Material costs are probably one of the largest components of your COGS. Typically, there’s no shortage of material suppliers, which means you may be able to find cheaper products somewhere else.

Shopping around for materials from different suppliers is one solution, but you could also consider whether a part of your finished product could be replaced with a cheaper alternative. You may think that your customers love the sturdy metal used in your product, for example, but they could be just as happy with a plastic substitute.

It may also be worth revisiting technology used in production to identify whether new processes mean cheaper materials can be used.

Whichever strategy you use, be careful of using cheaper materials at the expense of your end product. Providing a consistent experience is one of the best ways to build trust in your brand, and customers expect to receive the same product every time.

Even loyal customers can quickly switch to competitors if your products are not up to their expectations. A drop in sales can be far more significant than any savings you’ve gained by switching materials.

That’s not the only downside you need to consider, however. Inferior materials can also reduce the durability of your product. Changing materials may necessitate a change in the manufacturing process. This could increase production overheads or labor costs to such an extent that they nullify any costs saved.

3. Eliminate Costly Waste

There’s bound to be waste somewhere in your supply chain. Your manufacturing process may be inefficient, for example, and waste a lot of raw materials. You may even need to pay to dispose of them. Shrinkage may also be significant. This is when products are damaged, stolen, or go missing.

Waste doesn’t have to be physical. There could be plenty of time wasted in the manufacturing or shipping process that could be reduced to improve your COGS. Downtime can be expensive, whether that’s on the factory floor or when products are at sea.

Investigate all instances of waste in your supply chain, physical or otherwise, and take actions to reduce or eliminate the most expensive culprits.

One strategy could be to redesign the manufacturing process if material waste is significant. Another could be to alter transport arrangements if shrinkage is high and many products are arriving damaged.

4. Automate Parts of Your Business

Labor can be a significant part of your COGS. Luckily, you may be able to automate some of those expenses away. Every part of the manufacturing or shipping process that you can replace with a machine can save huge costs. Machines are typically cheaper to operate in the long run, there is less risk of error and have practically no downtime.

Once you’ve done your part, ask the same of your suppliers. Request they invest in automation to reduce costs if they haven’t already. You may even be able to use this as part of a negotiation strategy as discussed below. If they’re not willing to play ball, consider switching to another supplier investing in automation. If they aren’t cheaper right now, they could well be in the future.

5. Investigate Offshore Manufacturing

Manufacturing in the U.S. (or your country of origin) can often be a huge selling point. It can also be incredibly expensive. That’s why so many of the world’s biggest brands outsource manufacturing operations to countries like China, Taiwan, and Vietnam.

Both raw materials, labor, and utility costs are often much cheaper in these countries than they are at home, meaning your business stands to save in multiple ways. Even when you factor in increased shipping costs, your COGS could still plummet when you outsource manufacturing.

Only large enterprises should consider this strategy, however. The upfront costs can be substantial, and there are a lot of risks involved.

Quality problems may arise, for instance, and you may have to deal with PR issues as a result of labor conditions in these countries. Currency fluctuations and customs duties can complicate matters further.

For some businesses, however, the opportunity to drastically reduce their COGS will be well worth it.

6. Consider Manufacturing on Demand or Dropshipping

One of the biggest contributing factors to COGS is inventory purchases made throughout the year. The more products you buy, the more costs rise.

Rather than stock products that may not sell, brands could reduce their COGS by using a manufactured on-demand strategy. In essence, you only make or order products when a customer has already paid.

Print-on-demand sites like Printful and dropshipping are two of the most-common ways to leverage this strategy.

With Printful, products are printed in real-time as soon as an order is made. There’s not even a minimum order limit.

It’s the same with dropshipping. Businesses only pay for products when the customer pays for them. In both cases, items can be shipped directly to customers, meaning stores don’t need to hold any inventory.

7. Negotiate With Everyone

You can and should be regularly negotiating prices with every company in your supply chain. The prices you pay suppliers are a core part of your COGS. Reduce them, and your COGS will decrease, too.

When I say every company, I really do mean all of them. Manufacturers, raw material providers, logistics companies, storage facilities, and wholesalers are all able to give you a lower price if you ask.

Here are some deals you could ask for:

- lower per-unit prices

- bulk discounts

- lower prices in return for quicker payments

- lower prices in return for upfront payment

- lower minimum order requirements

Remember, negotiation is a two-way street. While some companies will be willing to lower prices just to keep your business, others will require something in return to sweeten the deal. Improving their payment terms, for instance, is always a useful bargaining chip.

It’s also important to remember your negotiations may have unintended consequences. Asking for bulk discounts will require you to store more products, for example, and come with a cost increase that may eclipse any savings you made. Asking for lower prices in return for faster payments may require you to improve your cash flow.

Think carefully about what you are asking for and make sure you can handle the consequences of your negotiations. The last thing you want to do is renege on a deal because you negotiated poorly.

Conclusion

Boosting your sales is essential, but so is reducing your company’s COGS. Whether it’s negotiating hard with suppliers, reducing waste, or automating your processes, look to reduce costs in every way possible.

I’ve given you seven strategies to get started with, but there are always more ways to reduce costs.

What innovative ways to reduce costs have you found?

This content was originally published here.